As we approached the end of January, I had a good idea of what I’d like to talk about in our View from theSquare this month until recent moves in the precious metals market grabbed the headlines. Having written on our positive outlook on gold and meaningful allocation for a while now, I ripped up the first draft and thoughtI’d bring some clarity and context to this area.

Why did the prices fall so dramatically?

The news headlines will have you believe the reason for the fall is due to President Trump’s announcement that Kevin Warsh will be his nomination for the next FederalReserve chair. Warsh, a former Federal Reserve Governor from 2006-2011, is seen to be more Hawkish, which simply means he has traditionally been more inclined to keep interest rates higher in order to prevent inflation from rising too quickly and generally prioritises price stability over short‑term economic boosts (higher interest rates are generally seen to be negative for gold prices).

However, I believe there is a much simpler reason.

In my opinion, the price movements in precious metals are part of a long term structural rising market and there are periods where new investors pile in (often termed as FOMO -fear of missing out), driving the price higher quickly. As a result, there can sometimes be disorderly corrections as previous holders quickly take profits.

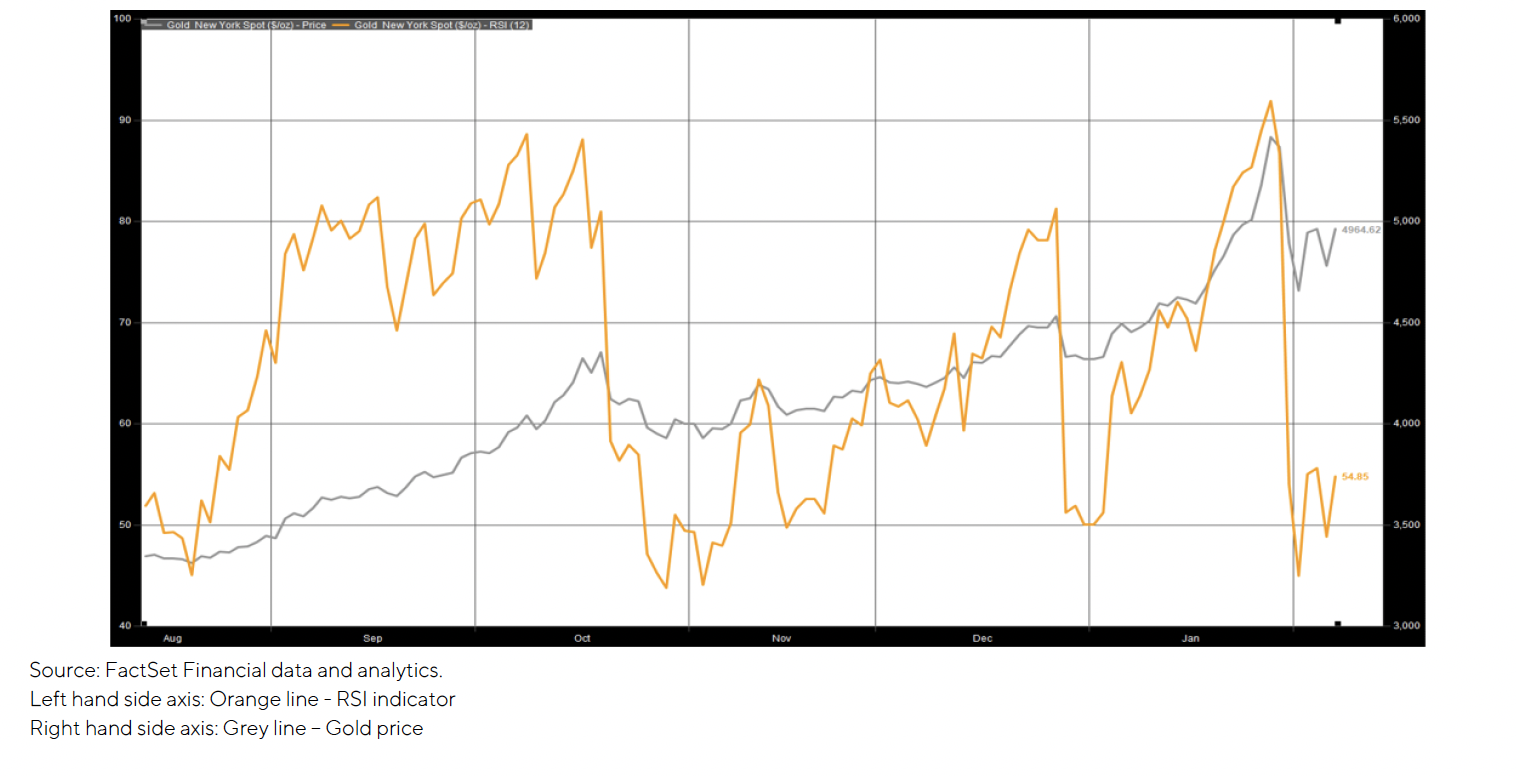

We don’t often use technical charting but it can be interesting to use in times like this and one factor that I do look for is called the RSI (relative strength index). When a stock or price trades at an RSI of 50, it means thatthere is an equal amount of buying as there is selling. An index level of 0 means there is only selling and anindex level of 100 means only buying. On 28 and 29 January, the price of gold moved from around $5,000to a peak of around $5,600, an unusually strong run on no news and at close of business on 29 January, theRSI level was above 90 (i.e. extremely favoured towards buyers and overbought territory).

The market needed a catalyst to dial back this recent run and President Trump duly delivered with his announcement on Friday morning. Now, that doesn’t mean that we should ignore the transition that will come if (as expected) Kevin Warsh is confirmed as the new Federal Reserve chair but given that his views and policy stance are not an extreme change, we can be fairly confident that the fundamentals of our positive gold stance remain intact.

What are we watching out for?

As we have explained before, the key drivers of the gold price are primarilycentral bank buying, U.S. dollar direction, inflation/interest rate trends and geopolitical instability.

1. Central Bank buying – demand from China and other emerging countries remains encouragingly strong.

2. Interest‑rate expectations – while Warsh has initially been perceived to be against aggressive rate cuts given his longer term record has a focus on controlling inflation, he has recently aligned with calls for lower interest rates, criticising the Fed’s reluctance to cut and arguing that rates “should be lower”.

3. U.S. dollar direction – the dollar fell to a four year low in January and while a slower pace of rates cuts in theUS will be beneficial for the greenback, it still remains expensive relative to other currencies and could likelycontinue moving lower. While inflation is expected to continue declining, in the US, it may return to target more slowly than expected.

4. Geopolitical developments, Venezuela, Ukraine, Greenland and Iran to name a few keep demand for safe haven assets elevated.

The bottom line: the recent price movements are a timely reminder that markets don’t move in a straight line, no matter how strong the evidence is in its favour. We are keeping a close eye on movements but to contextualise, the gold price at the start of the year was around $4,350 and at the time of writing, is around $4,964, so despite the recent movements (and admittedly, alarming headlines), gold still remains a structurally strong investment and less than $50 lower than when the spike and fall happened. Given the fundamental drivers are largely unchanged, we remain comfortable with our overall position in gold.

Liam Goodbrand

Investment Director

6 February 2026

Keep Informed

Sign up to our View from the Square.